U.S. Healthcare Real Estate Market Surges with Health System Consolidations

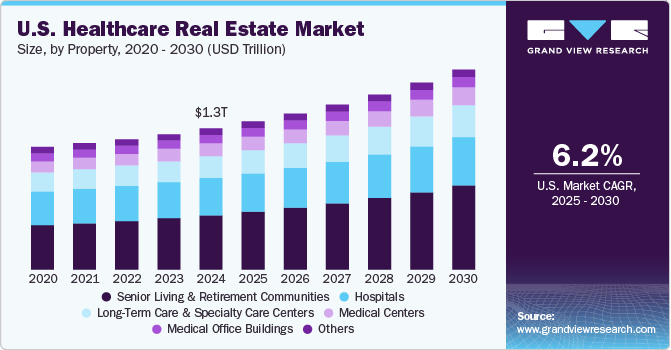

The U.S. healthcare real estate market size was estimated at USD 1,324.52 billion in 2024 and is projected to reach USD 1,876.77 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030.

The sector has witnessed significant expansion over the past decade, primarily fueled by demographic shifts, rising healthcare expenditures, and evolving care delivery models. A key driver is the aging U.S. population. According to the U.S. Census Bureau, approximately 62 million individuals aged 65 and above resided in the country in 2024, making up about 18% of the total population. This marks a substantial increase compared to earlier decades and highlights a continuing demographic transformation.

This aging trend is expected to persist. The Congressional Budget Office (CBO) anticipates the population aged 65 and older will grow to nearly 84 million by 2054, comprising around 23% of the national population. As older adults typically require more frequent and complex medical care, demand for advanced healthcare facilities, long-term care services, and professional medical staff is expected to rise sharply.

According to the American Hospital Association, the U.S. will have 6,093 hospitals by 2025, including 5,112 community hospitals. With a population of approximately 331 million, this equates to about 1.84 hospitals per 100,000 people. This relatively low ratio emphasizes the critical need for new healthcare facilities, particularly in underserved areas, offering opportunities for real estate development in healthcare.

A rising number of hospitalizations, persistent physician shortages, and growing prevalence of acute and chronic illnesses continue to exert pressure on existing healthcare infrastructure. Conditions such as acute kidney injury (AKI) are becoming more widespread, largely due to aging demographics and increasing incidence of chronic diseases like diabetes and hypertension.

Hospitalizations in the U.S. are projected to reach 36.2 million in 2025 and are expected to climb to 40.2 million by 2035. This anticipated rise underlines the urgent necessity for expanded inpatient care capacity and new healthcare facility construction to meet escalating healthcare demands.

Order a free sample PDF of the U.S. Healthcare Real Estate Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Property-Based: The senior living and retirement community segment is witnessing notable growth, expected to expand at a CAGR of 7.7% from 2024 to 2030. This trend is largely driven by the aging baby boomer generation seeking comfortable, health-focused retirement solutions.

- Model-Based: The lease model accounted for a 65.10% market share in 2024. Leasing in healthcare real estate is becoming increasingly popular due to its flexibility and cost-efficiency, benefiting both providers and investors.

Market Size & Forecast

- 2024 Market Size: USD 1,324.52 billion

- 2030 Projected Market Size: USD 1,876.77 billion

- CAGR (2025–2030): 6.2%

Key U.S. Healthcare Real Estate Company Insights

Leading players such as Healthpeak Properties, Inc. and Ventas, Inc. continue to drive the sector's expansion. The market is anticipated to grow steadily, potentially reaching revenues of USD 2,270,404.3 million by 2030.

Top-tier healthcare REITs like Welltower Inc. ($82.34 B), Ventas Inc. ($24.94 B), and Healthpeak Properties Inc. ($14.44 B) dominate the competitive landscape. Their advantages stem from scale, diversification, strategic operator partnerships, and specialized portfolios. For example, Welltower Inc. manages the largest portfolio among healthcare REITs, including senior housing, outpatient centers, and health systems, ensuring a balanced and resilient investment approach.

Key U.S. Healthcare Real Estate Companies:

- Welltower Inc.

- Ventas, Inc.

- Healthpeak Properties, Inc.

- Omega Healthcare Investors, Inc

- Healthcare Realty Trust Incorporated

- CareTrust REIT, Inc

- The GEO Group, Inc

- Sabra Health Care REIT, Inc

- National Health Investors, Inc

- Medical Properties Trust, Inc

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion:

The U.S. healthcare real estate market is set to witness sustained and substantial growth driven by demographic evolution, escalating demand for medical infrastructure, and technological advancements in care delivery. With increasing investment in senior living, outpatient facilities, and long-term care, the sector remains a vital component of the broader healthcare ecosystem. Strategic development, combined with strong partnerships and operational expertise from leading REITs, positions the industry for long-term expansion and resilience.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness