Vegan Food Market Gains Traction Among Millennials and Gen Z Shoppers

The global vegan food market size was valued at USD 16.55 billion in 2022 and is anticipated to reach USD 37.5 billion by 2030, growing at a CAGR of 10.7% from 2023 to 2030. The primary driver behind this growth is the increasing awareness of the health and environmental benefits associated with a vegan diet.

Heightened concerns regarding animal welfare and cruelty have influenced a notable consumer shift from animal-based to plant-based diets. This change in dietary preference has contributed to the rising consumption of vegan food. For instance, Grubhub, a leading food delivery platform, recorded a 17% increase in vegan food deliveries in 2021. While the COVID-19 pandemic disrupted global food supply chains and distribution channels, the plant-based food sector showed resilience. ShelfNow, an online food retailer, reported a 156% increase in vegetarian meal sales and a 150% rise in vegan meal sales between 2020 and 2021.

Despite its strong growth, the vegan food market faces challenges such as the relatively high production costs of plant-based foods compared to animal-based alternatives. These elevated costs—attributed to expensive plant-based ingredients—could limit market penetration in low- and middle-income countries. Nevertheless, industry players are actively leveraging advanced technologies to enhance the taste and texture of vegan products. For example, Motif FoodWorks, Inc. is developing plant-based meat and cheese using extrudable fat and prolamin technologies.

The increasing global popularity of vegan food reflects a broader interest in plant-based living. Google Trends data from 2004 to 2022 highlights the U.K., Israel, New Zealand, Australia, and Austria as top regions showing interest in veganism. Meanwhile, meat consumption is declining in several regions. A Gallup Poll published in 2020 revealed that 23% of Americans consumed less meat in 2019 than in the previous year.

Health-conscious consumers are increasingly turning to plant-based products for their numerous benefits, such as managing blood pressure and reducing risks of heart disease, stroke, and certain cancers. The Asia Pacific region, in particular, is witnessing robust growth due to new product launches. In June 2020, Cargill, Incorporated introduced PlantEver in China, offering consumers plant-based protein options.

The growing prevalence of lactose malabsorption, which affects about 68% of the global population (according to the National Institute of Diabetes and Digestive and Kidney Diseases), is also fueling demand for dairy alternatives such as plant-based milk, cheese, yogurt, ice cream, and frozen desserts. For example, in February 2022, Gaia's Farming Co. launched Hemp & Coco Mlk and Hemp & Oat Mlk as part of its dairy-free product line. The market has also benefited from manufacturers introducing innovative flavors and packaging to attract a wider consumer base.

Order a free sample PDF of the Vegan Food Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America accounted for the largest revenue share of over 37.2% in 2022.

- Asia Pacific is projected to be the fastest-growing regional market with a CAGR of 11.6% through 2030.

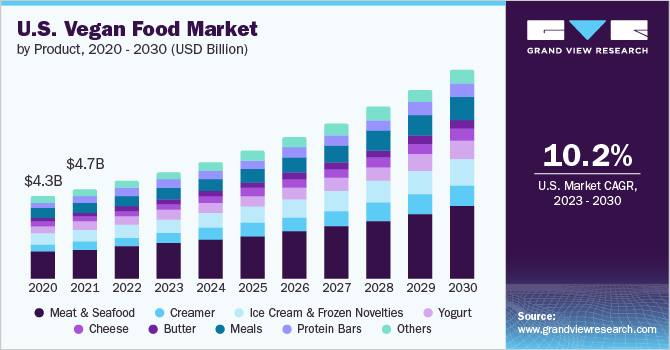

- Meat & seafood substitutes dominated the product category with a 36.2% market share in 2022.

- The offline distribution channel held a substantial share of 83.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 16.55 Billion

- 2030 Projected Market Size: USD 37.5 Billion

- CAGR (2023–2030): 10.7%

- Leading Region (2022): North America

- Fastest Growing Region: Asia Pacific

Key Companies & Market Share Insights

- Growing demand for vegan products has prompted manufacturers to innovate and expand their product portfolios. Notable developments include:

- Daiya Foods (March 2023): Invested in fermentation technology to improve product offerings.

- Upfield (July 2021): Launched its vegan cheese brand Violife in the Middle East.

- Target (May 2021): Introduced the plant-based Good & Gather brand with 30 product variants.

- Treeline Cheese (March 2020): Released plant-based cream cheese in three flavors using cultured cashews.

Prominent players in the global vegan food market include:

- Amy's Kitchen

- Danone S.A

- Daiya Foods Inc.

- Beyond Meat

- Tofutti Brands Inc.

- Plamil Foods Ltd

- VBites Foods Limited

- Eden Foods Inc.

- VITASOY International Holdings Limited

- SunOpta

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global vegan food market is on a strong growth trajectory, driven by rising health consciousness, ethical concerns, and innovations in food technology. While high production costs may pose a barrier in some regions, the increasing demand for sustainable and health-friendly alternatives continues to create substantial opportunities for manufacturers. Expanding product portfolios, regional market penetration, and technological advancements are expected to sustain market momentum through 2030.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness