Australia Legal Cannabis Market Segmentation To Understand Consumer Preferences

The Australia legal cannabis market was valued at USD 123.9 million in 2024 and is projected to reach USD 815.1 million by 2033, expanding at a CAGR of 20.3% from 2025 to 2033. The market is primarily driven by the increasing awareness of the health benefits of cannabis and the progressive legalization of marijuana, especially for medical purposes.

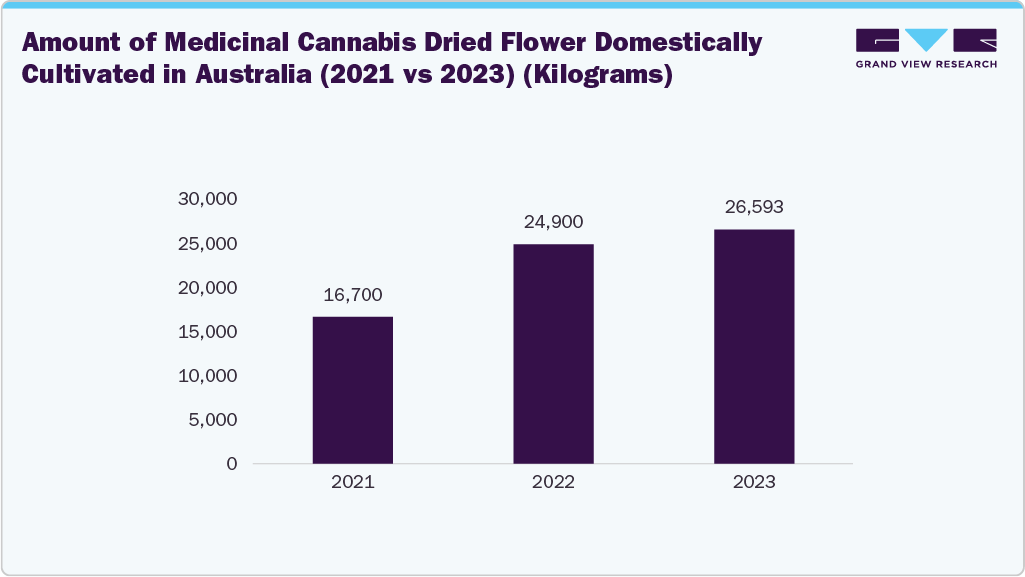

The surge in medical marijuana production due to rising demand in the pharmaceutical sector is also contributing to market growth. Since 2016, the Australian Government has legalized cannabis for medicinal use across all six states and two territories. Regulation of medicinal cannabis products is overseen by the Therapeutic Goods Administration (TGA).

Australia’s legal cannabis framework is dynamic and continues to evolve. In recent years, new legislation has allowed residents of the Australian Capital Territory (ACT) to cultivate up to four cannabis plants per household for personal use. In October 2023, ACT implemented updated regulations permitting adults over 18 to possess cannabis—up to 150 grams fresh or 50 grams dried—further contributing to increased usage and acceptance of cannabis products in the country.

Key Market Trends & Insights

- By Source: The hemp segment led the market in 2024, accounting for 67.1% of total revenue. This is attributed to the rising prevalence of health issues such as epilepsy and sleep disorders, along with increasing demand for hemp-derived products, including CBD oils and supplements known for their therapeutic benefits.

- By Derivatives: The CBD segment held the largest share at 63.5% in 2024. This growth stems from the legalization of low-dose CBD products by the TGA. Although these products are not yet registered on the Australian Register of Therapeutic Goods (ARTG), they are accessible under the Authorised Prescriber and Special Access schemes, allowing medical professionals to provide patients with CBD-based treatments.

- By End Use: The industrial application segment dominated the market, contributing 63.6% of revenue in 2024. There is growing demand for hemp fibers and oil in various sectors including construction, personal care, food and beverage, automotive, and textiles. Hemp is increasingly used in products such as varnishes, lubricants, solvents, coatings, printing inks, and paints, supporting segment expansion.

Order a free sample PDF of the Australia Legal Cannabis Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 123.9 Million

- 2033 Projected Market Size: USD 815.1 Million

- CAGR (2025-2033): 20.3%

Key Companies & Market Share Insights

The Australian legal cannabis market is witnessing increasing competition as companies adopt strategies such as product innovation, partnerships, and mergers and acquisitions to grow their market share.

In October 2023, AgriFutures Australia, a Research and Development Corporation, announced an investment of USD 2.5 million over five years to fund research in key areas including hemp primary production, hemp seeds and varieties, sustainability, and product development.

Notable players in the market include:

- Zelira Therapeutics

- AusCann Group Holdings Ltd.

These companies focus on supplying cannabis for medicinal use.

Emerging players such as ECOFIBRE and Bod Australia are actively involved in partnerships and clinical research, aiming to advance the development and accessibility of cannabis-based medical products in the country.

Key Players

- Cann Group Limited

- Zelira Therapeutics

- AusCann Group Holdings Ltd.

- Bod Australia

- Althea Group

- ECOFIBRE

- Botanix Pharmaceuticals

- EPSILON

- Little Green Pharma

- Incannex

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Australia legal cannabis market is poised for strong and sustained growth, driven by increasing medical acceptance, evolving legislation, and expanding industrial applications of hemp and cannabis-derived products. With favorable regulatory frameworks, especially in regions like the ACT, and growing investment in research and product development, the industry is expected to witness significant transformation through 2033. As both established and emerging players invest in innovation and partnerships, the market is set to expand rapidly, creating new opportunities across the medical, industrial, and wellness sectors.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness