-

أخر الأخبار

- استكشف

-

الصفحات

-

المجموعات

-

المناسبات

-

المدونات

Automotive Finance Market: The Rise of EV Financing and Subscription Services

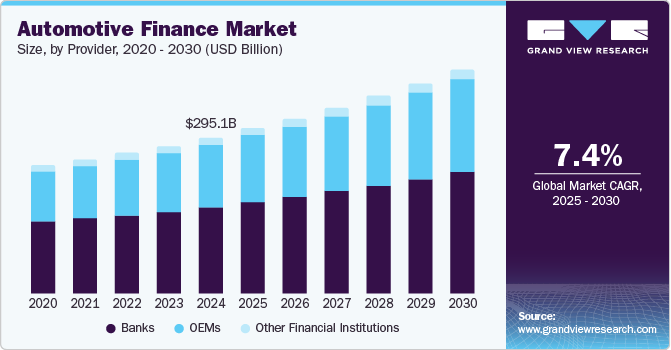

The global automotive finance market was valued at USD 295.13 billion in 2024 and is expected to reach USD 451.71 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. A key driver of this growth is the rising global demand for electric vehicles (EVs). According to Experian’s State of the Automotive Finance Report: Q2 2024, the share of EVs in automotive finance rose to 25.35%, up from 21.14% in the previous year and 19.30% in Q2 2022.

The increasing prominence of captive automotive finance is opening new growth opportunities. Captive finance subsidiaries—such as Honda Finance, Ford Credit, Infiniti Financial Services, and Nissan Finance—offer tailored loan and rental solutions to customers, helping automakers drive sales and enhance customer experience.

Another key trend influencing market growth is the emergence of cryptocurrency in automotive financing. Various companies are integrating crypto-based payment options to broaden their financial offerings. For example, in March 2022, CarNow, a digital retailing company in the automotive industry, partnered with Cion Digital, a blockchain platform, to offer fast, compliant crypto payments and lending services to auto dealers.

Key Market Trends & Insights

- Europe dominated the global automotive finance market in 2024, accounting for 39.3% of global revenue. This is due to a dense presence of finance service providers and a shift toward digital and mobile financing platforms, which are providing a competitive edge over traditional financing channels.

- By provider, the banks segment led the market with a 57.5% revenue share in 2024. This dominance is linked to faster loan processing, minimal documentation, and high reliability. Historically, banks have financed approximately 70%–80% of the vehicle cost.

- In terms of finance, the direct finance segment held a significant share in 2024, driven by consumers’ preference to approach financial institutions—like banks or credit unions—directly for auto loans that best match their needs.

- By purpose, the loan segment emerged as the leading choice in 2024. Loans remain the conventional approach for most consumers purchasing vehicles. With an evolving credit environment, leasing and finance firms are increasingly able to offer more accessible funding.

- In terms of vehicle, passenger vehicles led the market in 2024. This trend is supported by increased mobility needs, lifestyle changes, and growing demand for advanced vehicle technologies, including ADAS, infotainment systems, and in-car connectivity.

Order a free sample PDF of the Automotive Finance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 295.13 billion

- 2030 Projected Market Size: USD 451.71 billion

- CAGR (2025-2030): 7.4%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The automotive finance market remains fragmented and in a growth stage, with competition expected to intensify during the forecast period. Key players are leveraging strategies such as mergers and acquisitions, partnerships, geographical expansion, and exploration of subscription-based models to strengthen market presence.

The rise of vehicle subscription models—where customers pay monthly fees to use vehicles instead of owning them—is reshaping market dynamics. These models are gaining popularity, especially among younger demographics, and are contributing to market acceleration.

The COVID-19 pandemic further accelerated the adoption of online and digital channels for car financing. In response, OEMs and financial institutions have adapted by virtualizing their dealership services and enabling remote agreements.

- Bank of America stands out as a major financial institution in automotive lending, offering auto loans for new and used vehicles, refinancing options, and dealership-based financing across the U.S.

- Ford Motor Credit Company, a wholly-owned subsidiary of Ford Motor Company, provides retail and commercial financing solutions globally. Its offerings span loans, leases, and fleet financing for both Ford and Lincoln vehicles across regions including North America, Europe, Asia Pacific, and Latin America.

Key Players

- Ally Financial

- Bank of America

- Capital One

- Chase Auto Finance

- Daimler Financial Services

- Ford Motor Credit Company

- GM Financial Inc.

- Hitachi Capital

- Toyota Financial Services

- Volkswagen Financial Services

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global automotive finance market is on a strong growth trajectory, fueled by rising electric vehicle adoption, digital transformation in financial services, and the expansion of innovative models like subscriptions and crypto payments. While Europe leads in market share, Asia Pacific is expected to experience the fastest growth due to increasing vehicle demand and financial inclusion. As traditional lenders and captive finance companies continue to evolve and embrace emerging technologies, the automotive finance landscape will become more dynamic and consumer-focused through 2030.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness