Bromine Market Dynamics: Innovations and Technological Advancements

The global bromine market was valued at approximately USD 1.98 billion in 2024 and is projected to reach USD 3.28 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.7% from 2025 to 2033. Bromine is predominantly utilized in the production of flame retardants, particularly brominated flame retardants (BFRs), which play a crucial role in enhancing fire safety across various sectors, including electronics, textiles, and construction materials.

As global safety regulations tighten, especially in developing economies where fire safety standards are being upgraded, the demand for bromine-based flame retardants is on the rise. Additionally, bromine-based drilling fluids, such as clear brine fluids (CBFs), are vital for deep and high-pressure oil wells, providing the necessary density to control wellbore pressure while remaining non-damaging to reservoir rock. With the increasing global energy demand and the expansion of exploration activities into challenging environments, the consumption of bromine in this sector is expected to remain robust, particularly in regions like the Middle East and North America.

The pharmaceutical and agrochemical sectors also significantly contribute to bromine demand. In pharmaceuticals, bromine is used to synthesize several intermediates and active pharmaceutical ingredients (APIs), notably in sedatives and analgesics. In agriculture, bromine compounds are utilized in fumigants and pesticides, particularly in regions where soil-borne pathogens and pests affect crop yields. Despite regulatory restrictions in some areas, innovations in safer bromine-based chemicals continue to drive growth in these industries.

Key Market Trends & Insights

- The North America: The bromine industry in North America is steadily growing, driven by strong demand from the oil and gas and electronics sectors. Bromine is essential for producing clear brine fluids that control pressure in deep and high-temperature oil wells. As drilling activities increase, especially in the U.S., the demand for bromine-based fluids is rising. Additionally, brominated flame retardants are widely used in electronics and construction to meet fire safety regulations.

- S. Market: The U.S. bromine industry benefits from significant investments in domestic energy production and infrastructure. The drive for energy independence has led to increased oil and gas drilling activities, particularly in shale-rich regions and offshore basins, creating a consistent demand for bromine-based inputs.

- Product Segmentation: Elemental bromine accounted for the largest market revenue share in 2024. It serves as a precursor for brominated flame retardants (BFRs), clear brine fluids, and various organic and inorganic bromine compounds. The demand for BFRs, such as TBBPA and hexabromocyclododecane, continues to grow, especially in the Asia Pacific region, where major electronics manufacturing hubs are located.

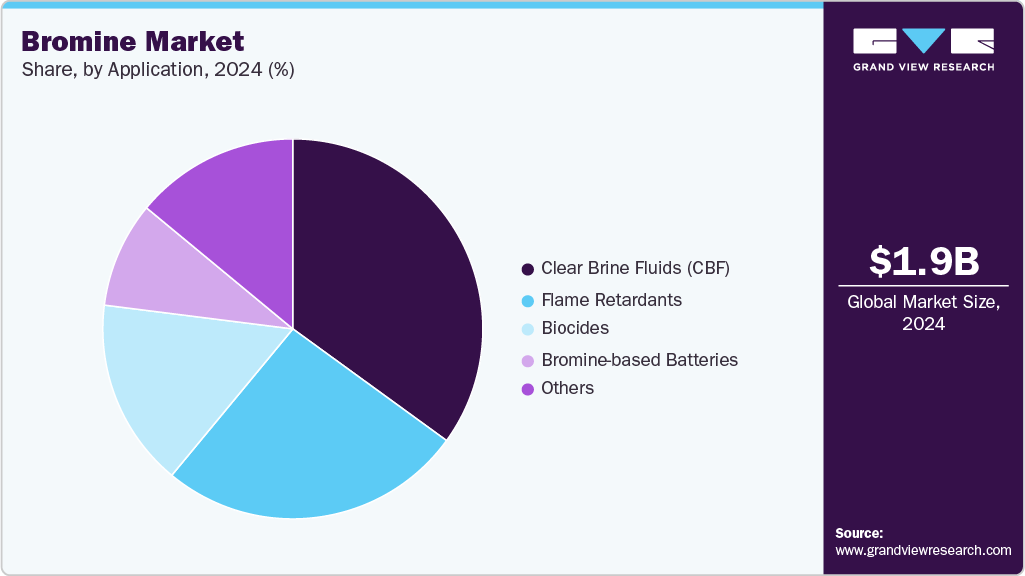

- Application Insights: Clear brine fluids represented the largest market revenue share in 2024, driven by demand from the oil and gas industry, particularly in offshore and deepwater drilling. CBFs are critical for maintaining wellbore stability and controlling pressure in high-temperature and high-pressure drilling scenarios.

Order a free sample PDF of the Bromine Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 1.98 Billion

- 2033 Projected Market Size: USD 3.28 Billion

- CAGR (2025-2033): 5.7%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Key players in the bromine market include ICL Group Ltd., Albemarle Corporation, and others.

- ICL Group Ltd.: A global specialty minerals and chemicals company based in Israel, ICL is the largest producer of elemental bromine and bromine compounds. The company offers a wide range of bromine-based solutions for flame retardants, oil and gas, water treatment, and pharmaceuticals, focusing on environmentally safer products.

- Albemarle Corporation: Based in the U.S. and listed on the S&P 500, Albemarle is one of the largest global producers of bromine and its derivatives. The company’s Bromine Specialties business supplies high-performance products across various sectors, including flame retardants and agriculture, supported by a vertically integrated operation.

Key Players

- ICL Group Ltd.

- Albemarle Corporation

- LANXESS AG

- Tosoh Corporation

- TETRA Technologies Inc.

- TATA Chemicals Ltd.

- Hindustan Salts Ltd.

- Honeywell International Inc.

- Gulf Resources Inc.

- Agrocel Industries Pvt Ltd.

- Satyesh Brinechem Pvt. Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The bromine market is positioned for significant growth, driven by increasing demand across various industries, stringent safety regulations, and ongoing innovations in bromine-based applications. With a strong outlook, particularly in the oil and gas and electronics sectors, the market is set to expand, offering numerous opportunities for key players to innovate and cater to evolving consumer needs.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness