North America Digital Payment Market Innovation, Size, Share, Growth and Trend Analysis By 2032

Executive Summary North America Digital Payment Market :

Executive Summary North America Digital Payment Market :

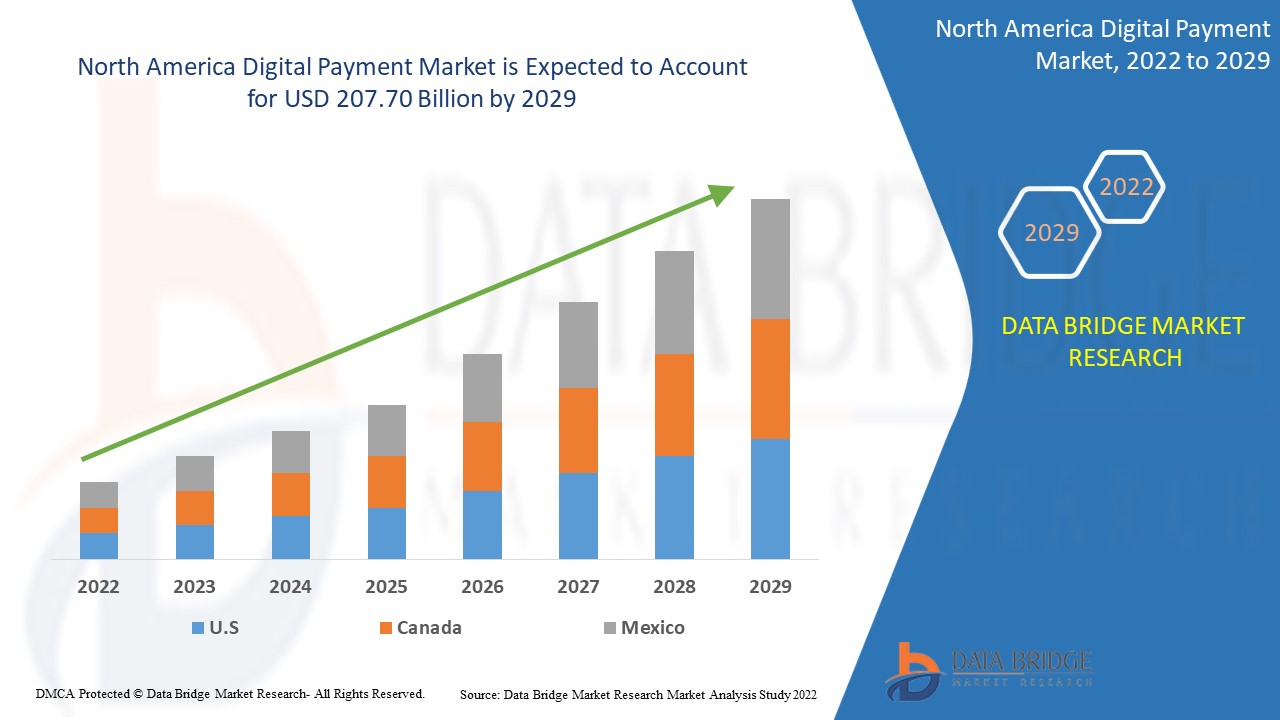

Global digital payment market was valued at USD 50.62 billion in 2021 and is expected to reach USD 207.70 billion by 2029, registering a CAGR of 19.30% during the forecast period of 2022-2029.

The market insights gained through this North America Digital Payment Market research analysis report facilitates more defined understanding of the market landscape, issues that may interrupt in the future, and ways to position definite brand excellently. With the scrupulous competitor analysis covered in this report, businesses can gauge or analyse the strengths and weak points of the competitors which helps build superior business strategies for their own product. For in depth understanding of market and competitive landscape, this North America Digital Payment Market research report serves a lot of parameters and detailed data about industry.

An effective research methodology used in this North America Digital Payment Market report consists of data models that include market overview and guide, vendor positioning grid, market time line analysis, company positioning grid, company market share analysis, standards of measurement, top to bottom analysis and vendor share analysis. Most relevant, unique, and creditable global market research report has been provided to the valuable customers and clients depending upon their specific business needs. The North America Digital Payment Market report is generated with the systematic gathering and analysis of information about individuals or organizations which is conducted through social and opinion research.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive North America Digital Payment Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/north-america-digital-payment-market

North America Digital Payment Market Overview

**Segments**

- On the basis of component, the North America digital payment market can be segmented into solutions and services. The solutions segment is further divided into payment processing, payment gateway, payment wallet, POS solution, payment security, and fraud management. On the other hand, the services segment includes professional services and managed services.

- Based on deployment type, the market can be categorized into cloud and on-premises. The cloud segment is anticipated to witness substantial growth due to benefits such as cost-efficiency, scalability, and flexibility.

- In terms of organization size, the North America digital payment market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The SMEs segment is predicted to grow at a rapid pace owing to increasing adoption of digital payment solutions among small businesses.

- By payment mode, the market is divided into card payments, digital wallets, internet banking, and others. The card payments segment is expected to dominate the market share due to the widespread acceptance of debit and credit cards for online transactions.

- On the basis of vertical, the market can be segmented into retail, BFSI, healthcare, IT and telecom, hospitality, and others. The retail sector is expected to lead the market growth due to the rise in e-commerce activities and the shift towards digital payments.

**Market Players**

- Some of the key players operating in the North America digital payment market include PayPal Holdings, Inc., Visa Inc., Mastercard, American Express, Apple Inc., Google LLC, Square, Inc., Stripe, Inc., Intuit Inc., and PayU.

- These players are focusing on strategic collaborations, partnerships, and product innovations to gain a competitive edge in the market. Moreover, investments in research and development activities to enhance their digital payment solutions and services are driving the market growth.

In conclusion, the North America digital payment market is witnessing significant growth driven by factors such as increasing smartphone penetration, rising e-commerce activities, and shifting consumer preferences towards cashless transactions. The market segmentation based on components, deployment type, organization size, payment mode, and verticals provides insights into the diverse dynamics shaping the market landscape. With key players investing in technological advancements and strategic initiatives, the market is poised for further expansion and innovation in the coming years.

The North America digital payment market is experiencing a profound transformation fueled by the relentless technological advancements and changing consumer behaviors. One emerging trend that could significantly impact the market is the increasing focus on contactless payment methods. With concerns around health and safety amid the global pandemic, consumers are increasingly opting for touchless payment solutions, leading to a surge in demand for contactless payment technologies. This shift is driving the adoption of NFC-enabled devices and mobile wallets, as they offer a convenient and secure way to make transactions without physical contact.

Another key trend shaping the North America digital payment market is the rise of embedded finance solutions. As more industries seek to integrate financial services seamlessly into their offerings, we are witnessing a convergence of traditional financial services with various non-financial sectors. This trend is creating new revenue streams and enhancing customer loyalty by providing integrated payment solutions within different applications and platforms. Companies are leveraging APIs and partnerships to embed financial services, such as payments, lending, and insurance, into their ecosystems, thereby streamlining the overall customer experience.

Furthermore, the market is witnessing a rapid evolution in the realm of biometric authentication for digital payments. Biometric technology, including fingerprint recognition, facial recognition, and voice authentication, is enhancing security measures and improving the user experience in payment processes. By incorporating biometric verification methods, businesses can offer a seamless and secure payment experience by ensuring the authenticity of transactions and reducing fraud risks. This trend is gaining traction across various industries, including banking, retail, and healthcare, as organizations prioritize data security and customer trust.

Moreover, the convergence of artificial intelligence and machine learning technologies is revolutionizing fraud detection and prevention in the digital payment landscape. By leveraging advanced algorithms and predictive analytics, companies can detect anomalies, identify patterns of fraudulent activities, and proactively mitigate risks in real time. The integration of AI-powered fraud detection tools enables businesses to enhance security protocols, streamline operations, and protect sensitive financial information against evolving cyber threats. This trend underscores the importance of leveraging data-driven insights to fortify cybersecurity measures and safeguard digital payment transactions.

In conclusion, the North America digital payment market is undergoing a paradigm shift driven by the convergence of innovative technologies, changing consumer preferences, and industry collaborations. The emergence of trends such as contactless payments, embedded finance solutions, biometric authentication, and AI-driven fraud detection is reshaping the payment ecosystem and paving the way for enhanced security, efficiency, and convenience in digital transactions. As companies continue to adapt to these transformative trends and embrace digitalization, the landscape of digital payments in North America is poised for continuous evolution and expansion in the foreseeable future.The North America digital payment market is experiencing a profound transformation as technological advancements and changing consumer behaviors drive innovation and growth. One significant trend shaping the market is the increasing adoption of contactless payment methods, driven by the prioritization of health and safety during the global pandemic. This shift towards touchless payment solutions is fueling demand for NFC-enabled devices and mobile wallets, offering convenient and secure transaction options without physical contact. The emphasis on contactless payments is reshaping the payment landscape, influencing consumer preferences and accelerating the development of seamless payment technologies.

Another key trend impacting the North America digital payment market is the emerging prominence of embedded finance solutions. This trend involves the integration of financial services into non-financial sectors, enabling companies to offer comprehensive payment solutions within their platforms. By embedding payments, lending, and insurance services seamlessly, businesses can enhance customer experience, create new revenue streams, and drive customer loyalty. Through strategic partnerships and the use of APIs, organizations are integrating financial functionalities into various applications, paving the way for a more integrated and convenient payment ecosystem.

Furthermore, the market is witnessing a rapid evolution in biometric authentication for digital payments, with biometric technologies such as fingerprint recognition, facial recognition, and voice authentication gaining traction in enhancing security measures. By incorporating biometric verification methods, businesses are improving transaction security, reducing fraud risks, and offering a seamless payment experience to consumers. The adoption of biometric authentication across industries underscores the growing importance of data security and customer trust in digital transactions, driving further innovation in the field of secure payment solutions.

Moreover, the convergence of artificial intelligence (AI) and machine learning technologies is revolutionizing fraud detection and prevention in the digital payment landscape. By leveraging advanced algorithms and predictive analytics, companies can detect fraudulent activities, identify patterns, and mitigate risks in real time, enhancing security protocols and protecting sensitive financial information against cyber threats. The integration of AI-powered fraud detection tools underscores the significance of data-driven insights in fortifying cybersecurity measures and ensuring safe digital payment transactions in an increasingly complex threat landscape.

In conclusion, the North America digital payment market is undergoing a transformative phase characterized by the adoption of contactless payments, the rise of embedded finance solutions, advancements in biometric authentication, and the integration of AI-driven fraud detection mechanisms. These trends are reshaping the payment ecosystem, enhancing security, efficiency, and convenience in digital transactions. As companies continue to innovate and adapt to changing market dynamics, the landscape of digital payments in North America is poised for continued evolution and expansion, driving forward a more secure and seamless payment experience for consumers and businesses alike.

The North America Digital Payment Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/north-america-digital-payment-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report can answer the following questions:

- Global major manufacturers' operating situation (sales, revenue, growth rate and gross margin) of North America Digital Payment Market

- Global major countries (United States, Canada, Germany, France, UK, Italy, Russia, Spain, China, Japan, Korea, India, Australia, New Zealand, Southeast Asia, Middle East, Africa, Mexico, Brazil, C. America, Chile, Peru, Colombia) market size (sales, revenue and growth rate) of North America Digital Payment Market

- Different types and applications of North America Digital Payment Market share of each type and application by revenue.

- Global of North America Digital Payment Market size (sales, revenue) forecast by regions and countries from 2022 to 2028 of North America Digital Payment Market

- Upstream raw materials and manufacturing equipment, industry chain analysis of North America Digital Payment Market

- SWOT analysis of North America Digital Payment Market

- New Project Investment Feasibility Analysis of North America Digital Payment Market

Browse More Reports:

Global Depression Screening Market

Global Linear Low Density Polyethylene (LLDPE) Market

Global Oviposition-Deterring Pheromones Market

North America Electrosurgery Equipment Market

Middle East and Africa Persistent Corneal Epithelial Defects Treatment Market

Global Citrus Fruit Concentrate Puree Market

Global Video on Demand (VOD) Service Market

Asia-Pacific Speech and Voice Recognition Market

Global LASIK Eye Surgery Market

Global Tonsillitis Drugs Market

Global Liquid Bioinsecticides Market

Middle East and Africa Head-Up Display Market

Global Hedgehog Pathway Inhibitors Market

Global Salmon-derived Peptides Market

Global Farm Tractor Rental Market

Global Karyotyping Market

Global Wearable Computing Market

North America Specialty Paper Market

North America Smart Lighting Market

Asia-Pacific Viscosupplementation Market

Global Siding Market

Latin America Breast Reconstruction Market

North America Fraud Detection Transaction Monitoring Market

Europe Contrast Media Injectors Market

North America Automated Material Handling Market

Global Cold Chain Packaging Market

North America Refractories Market

Global Intelligent Professional Development Unit (PDU) Market

Global Urogynecologic Surgical Mesh Implants Market

Global Congestive Renal Failure (CRF) Market

Asia-Pacific Industrial Sugar Market

Global Obsessive-Compulsive Disorder (OCD) Drugs Market

Global Agricultural Robot Market

Global Cosmetic Mouthwash Market

Europe Usage-Based Insurance Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness