-

Ροή Δημοσιεύσεων

- ΑΝΑΚΆΛΥΨΕ

-

Σελίδες

-

Ομάδες

-

Events

-

Blogs

Trade Surveillance Market Strengthens with Real-Time Risk Assessment Tools

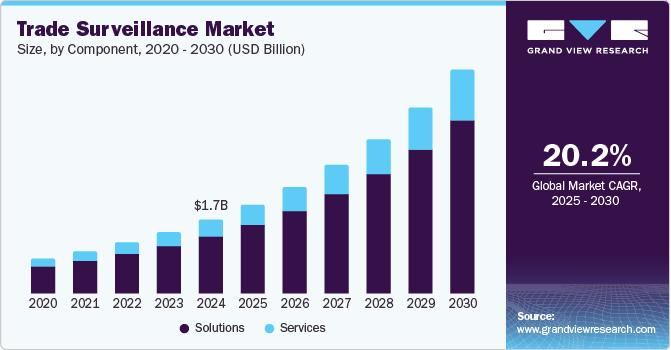

The global trade surveillance market size was estimated at USD 1.7 billion in 2024 and is projected to reach USD 5.2 billion by 2030, expanding at a compound annual growth rate (CAGR) of 20.2% from 2025 to 2030. This growth is primarily driven by the rising need for regulatory compliance and the increasing complexity of financial transactions.

Advancements in technologies such as artificial intelligence (AI) and machine learning (ML) are significantly enhancing surveillance capabilities. These innovations enable financial organizations to efficiently detect market vulnerabilities, insider trading, and other fraudulent activities. As institutions focus more on risk management and data-informed decision-making, the adoption of sophisticated trade surveillance solutions continues to rise globally.

The shift toward cloud-based trade surveillance solutions is also shaping market dynamics by providing scalable, flexible, and cost-effective systems. Financial institutions are increasingly relying on cloud technologies to improve data storage, streamline analytics processes, and ensure real-time monitoring of trading activities. Concurrently, regulatory authorities around the world are imposing more stringent compliance mandates, prompting firms to implement advanced systems with robust risk assessment and reporting functions. With the growth of automated and algorithmic trading strategies, the associated risks—such as market manipulation, fraud, and regulatory breaches—are intensifying, further emphasizing the importance of comprehensive monitoring tools.

AI integration and big data analytics are further accelerating market growth by enabling improved anomaly detection and predictive analysis. ML algorithms enhance monitoring by identifying patterns that signal suspicious behavior, reducing false positives, and increasing operational efficiency. Additionally, the proliferation of high-frequency trading, characterized by rapid and high-volume transactions, has heightened concerns about market abuse. As financial markets become more dynamic and digitized, the need for adaptive, automated trade surveillance systems becomes increasingly vital for ensuring compliance and protecting market integrity.

Order a free sample PDF of the Trade Surveillance Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Europe led the global trade surveillance market with a 35.0% share in 2024 and is anticipated to register the highest CAGR over the forecast period.

- The U.S. market is witnessing rapid growth, driven by strict regulatory oversight and the rising demand for advanced compliance solutions.

- By component, the solutions segment accounted for 76.7% of the market share in 2024.

- The on-premises deployment segment held the largest share of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.7 Billion

- 2030 Projected Market Size: USD 5.2 Billion

- CAGR (2025–2030): 20.2%

- Leading Region in 2024: Europe

Key Trade Surveillance Company Insights

Several major players are driving innovation and competition in the trade surveillance space through product development, partnerships, and expansion strategies.

- NICE is a global leader in compliance, financial crime, and risk management. It offers AI-powered solutions to detect fraud, market manipulation, and ensure regulatory adherence, helping institutions protect market integrity.

- Crisil Limited provides financial institutions with cutting-edge analytics, risk management, and regulatory compliance solutions. The company emphasizes transparency and operational efficiency, supporting organizations in anomaly detection and adherence to evolving regulations.

- Software GmbH and other key players continue to strengthen their global presence through strategic collaborations and the deployment of next-generation trade surveillance tools.

Leading Companies in the Trade Surveillance Market:

- NICE

- Crisil Limited

- Software GmbH

- Aquis Exchange

- Nexi S.p.A.

- Nasdaq, Inc.

- Scila

- OneMarketData, LLC

- ACA Group

- IPC System, Inc.

- b-next

- Trading Technologies International, Inc.

- FIS

- Wipro

- Red Deer (Kaizen Regtech Group Limited)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global trade surveillance market is undergoing rapid transformation, driven by increasing regulatory pressures, technological innovation, and the evolution of modern trading practices. As financial institutions continue to prioritize compliance, risk mitigation, and operational agility, the demand for intelligent, real-time surveillance solutions will remain robust. With AI, machine learning, and cloud computing at the forefront, the market is well-positioned for sustained growth, supporting global efforts to uphold transparency and security in financial markets.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness