-

Ροή Δημοσιεύσεων

- ΑΝΑΚΆΛΥΨΕ

-

Σελίδες

-

Ομάδες

-

Events

-

Blogs

U.S. Nuclear Medicine Market Expands Across Hospital and Lab Facilities

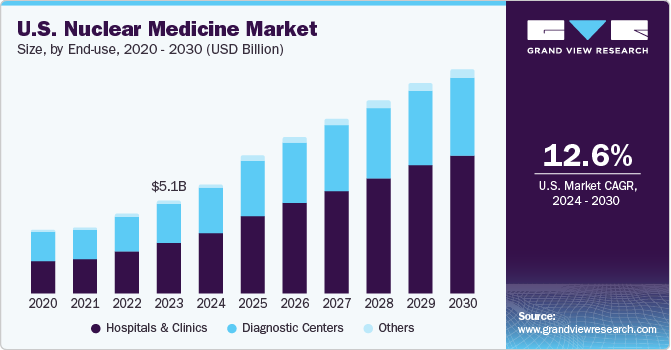

The U.S. nuclear medicine market size was estimated at USD 5.1 billion in 2023 and is projected to grow at a CAGR of 12.6% from 2024 to 2030. This growth is primarily driven by the increasing prevalence of cancer and cardiovascular diseases across the country. According to the American Cancer Society, the U.S. recorded approximately 1,958,310 new cancer cases in 2023, with 609,820 projected cancer-related deaths. The demand for nuclear medicine is further fueled by technological advancements and the growing need for precise diagnostic and treatment solutions.

Cardiovascular diseases remain the leading cause of death among most racial and ethnic groups in the U.S. As per a CDC report published in May 2023, around 805,000 Americans experience heart attacks annually, with 605,000 undergoing their first episode. To combat this, the U.S. government allocated nearly USD 239 billion annually between 2018 and 2019 for heart disease prevention and treatment, encompassing medication and healthcare services. Lifestyle factors such as alcohol consumption, unhealthy diets, and physical inactivity contribute significantly to the prevalence of cancer and heart diseases, thereby escalating the demand for nuclear medicine solutions.

The market is further driven by continuous technological innovation. Radiopharmaceuticals have transformed diagnostic and therapeutic practices in cardiology and oncology. Ongoing research highlights the efficacy of radioisotopes in treating a variety of health conditions, including cancer, thyroid disorders, respiratory ailments, bone issues, and gastrointestinal diseases. This scientific momentum is leading to the development of advanced nuclear medicine products for diagnostic and therapeutic use. For example, Siemens Healthineers introduced the Symbia Pro.specta in June 2022—an advanced SPECT and CT imaging system—which received both U.S. FDA clearance and CE mark approval for broad clinical application. Its features include automated workflows, SPECT motion correction for improved imaging, and a low-dose CT of up to 64 slices, setting it apart in the competitive landscape.

The demand for accurate diagnostic tools continues to rise, with Positron Emission Tomography (PET) gaining traction due to its precision in targeted organ analysis. PET scans offer superior accuracy compared to traditional diagnostic methods and are instrumental in evaluating treatment efficacy. Frequently combined with X-rays or CT scans, PET enhances diagnostic detail. In October 2023, Positrigo AG launched its NeuroLF PET system in the U.S. via its local subsidiary, reinforcing the importance of R&D and innovation in nuclear imaging technologies.

Order a free sample PDF of the U.S. Nuclear Medicine Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Product: Diagnostic products held a dominant share, accounting for 71.2% of total revenue in 2023.

- By End-use: Hospitals and clinics were the leading end-users in 2023.

- By Application: The oncology segment led the market by application share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.1 billion

- 2030 Projected Market Size: USD 12.27 billion

- CAGR (2024–2030): 12.6%

Key U.S. Nuclear Medicine Company Insights

Prominent market players such as GE Healthcare, Cardinal Health, Lantheus Medical Imaging, Siemens Healthineers AG, and Novartis leverage established regional networks to maintain stringent quality standards and secure competitive market shares. These companies invest significantly in advanced technologies and infrastructure to support high-volume diagnostics and therapies. Strategic partnerships and distributor collaborations further strengthen their positions.

Emerging players like NTP Radioisotopes SOC Ltd., Eczacıbaşı-Monrol, Lantheus Medical Imaging, and Nordion (Canada), Inc. are gaining visibility by securing government and institutional funding and launching novel products to address unmet needs in the U.S. market.

Key U.S. Nuclear Medicine Companies:

- Eckert & Ziegler

- Curium

- GE Healthcare

- Jubilant Life Sciences Ltd.

- Bracco Imaging S.P.A

- Nordion (Canada), Inc.

- The Institute for Radioelements (IRE)

- NTP Radioisotopes SOC Ltd.

- Eczacıbaşı-Monrol

- Lantheus Medical Imaging, Inc.

- The Australian Nuclear Science and Technology Organization

- Novartis (Advanced Accelerator Applications)

- Siemens Healthineers AG

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion:

The U.S. nuclear medicine market is poised for substantial growth due to a convergence of factors, including the rising burden of cancer and cardiovascular diseases, rapid technological innovations, and increasing investment in advanced imaging and therapeutic solutions. The adoption of highly accurate diagnostic tools such as PET and SPECT systems, combined with robust R&D activities and supportive government initiatives, will continue to drive the market forward. As major and emerging players expand their capabilities and partnerships, the landscape is set to evolve with new innovations catering to the growing demand for personalized and efficient healthcare solutions.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness