-

أخر الأخبار

- استكشف

-

الصفحات

-

المجموعات

-

المناسبات

-

المدونات

Distribution Automation Market Shows Growth in Rural Electrification

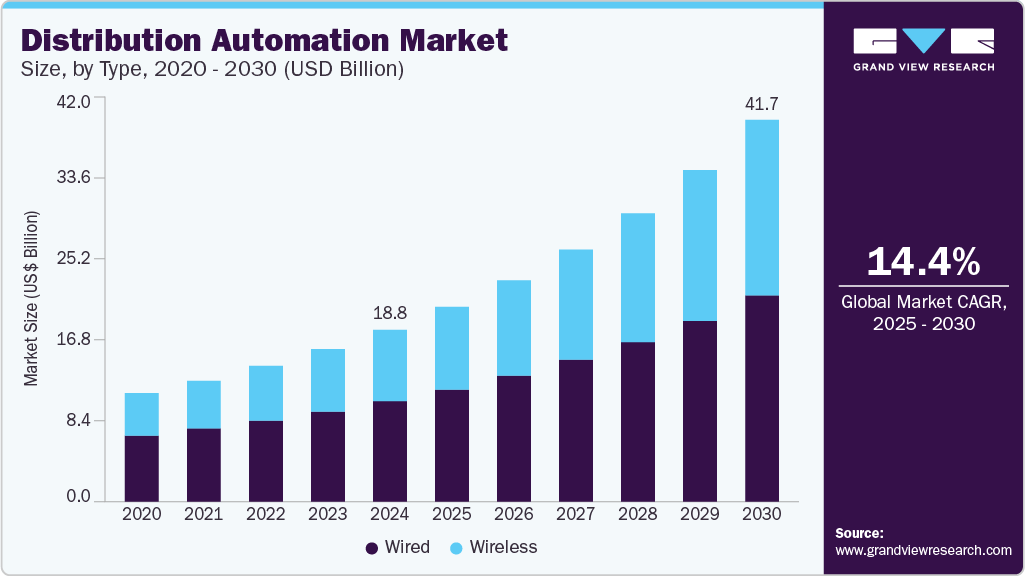

The global distribution automation market size was estimated at USD 18,833.4 million in 2024 and is projected to reach USD 41,721.3 million by 2030, growing at a CAGR of 14.4% from 2025 to 2030.

The adoption of smart grid technologies, alongside the integration of IoT, artificial intelligence, and cloud-based platforms, is driving utilities to boost operational efficiency and minimize outage times. Regulatory mandates emphasizing energy efficiency, grid reliability, and emission reduction are further accelerating the shift towards automation in power distribution systems. Moreover, the rising deployment of distributed energy resources (DERs), including solar and wind energy, is transforming how utilities manage their operations, contributing to market growth.

The proliferation of advanced communication systems and the development of smart grid infrastructure are key enablers of distribution automation. Utilities now leverage a variety of automation tools such as feeder automation, voltage regulation, automated switching, and real-time fault detection. These tools enhance the reliability and responsiveness of power networks, leading to reduced downtimes, improved load balancing, and quicker restoration times, all of which are vital to strengthening grid resilience.

Growing government support and funding for grid modernization is another major catalyst. Policies aimed at upgrading outdated infrastructure and enhancing power quality are motivating utilities to adopt intelligent automation systems. These systems enable real-time energy monitoring and optimization, resulting in reduced operational expenses and enhanced sustainability outcomes.

The accelerated adoption of IoT, AI, and advanced metering infrastructure (AMI) is reshaping the automation landscape. By investing in connected and cloud-enabled technologies, utility operators gain granular visibility into consumption patterns and grid performance. This digital integration supports predictive maintenance, faster fault detection, and more informed decision-making processes.

The increasing integration of renewable energy sources like solar and wind into power distribution networks is creating new opportunities for advanced automation solutions. As DERs become more widespread, the need for responsive and adaptive control systems becomes critical. Distribution automation enables the balancing of intermittent energy supply and demand, ensuring consistent grid performance and stability.

Order a free sample PDF of the Distribution Automation Market Intelligence Study, published by Grand View Research.

Key Highlights:

- North America held over 30% market share in 2024.

- The U.S. distribution automation market is expected to grow at over 12% CAGR from 2025 to 2030.

- The wired segment led by type with over 58% market share in 2024.

- Public utilities accounted for the largest application segment in 2024.

- Hardware remained the dominant component segment in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18,833.4 million

- 2030 Projected Market Size: USD 41,721.3 million

- CAGR (2025–2030): 14.4%

- North America: Largest market

- Asia Pacific: Fastest growing region

Key Distribution Automation Company Insights

- Schneider Electric SE stands out as a global leader in energy management and automation. The company offers comprehensive smart grid solutions, including the EcoStruxure™ Grid platform, which utilizes IoT, AI, and analytics to enhance efficiency, safety, and grid reliability.

- Siemens AG, known for its expertise in smart infrastructure, provides grid automation systems, SCADA, RTUs, and digital substations. These tools support grid modernization and improved network control, solidifying Siemens’ key position in the market.

- Trilliant Holdings Inc. is emerging as a major player with its scalable, secure smart communication platforms. Its integrated AMI, IoT, and analytics solutions help utilities modernize infrastructure and ensure network reliability across regions including North America, Europe, and Asia.

- NARI Technology Co., Ltd. is quickly expanding in the global market with advanced grid automation, energy management, and protection systems. With backing from China’s grid modernization efforts, NARI is gaining traction in both domestic and international markets.

Leading Companies in the Distribution Automation Market:

- Schneider Electric SE

- Siemens

- ABB

- Eaton

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Schweitzer Engineering Laboratories, Inc.

- Itron Inc.

- S&C Electric Company

- Xylem

- Trilliant Holdings Inc.

- NARI Technology Co., Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion:

The distribution automation market is undergoing a rapid transformation, driven by the convergence of advanced technologies, supportive regulatory frameworks, and the global shift toward clean energy. With increasing investments in smart grids, IoT integration, and DERs, the market is poised for sustained expansion. As utilities continue to prioritize grid resilience, operational efficiency, and sustainability, distribution automation will remain a vital component in the evolution of modern power systems.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness