-

Nieuws Feed

- EXPLORE

-

Pagina

-

Groepen

-

Events

-

Blogs

Middle East And Africa Diabetes Care Devices Market Sees Strategic Mergers

The Middle East & Africa (MEA) diabetes care devices market was valued at USD 1.03 billion in 2023 and is anticipated to grow at a CAGR of 8.20% from 2024 to 2030. This growth is largely attributed to the increasing prevalence of diabetes across the region, influenced by evolving lifestyles and associated health issues. Diabetic patients must consistently monitor and manage their blood glucose levels, requiring routine use of insulin or carbohydrate intake adjustments. As diabetes becomes a mounting healthcare concern, the demand for effective diabetes management tools continues to grow.

According to the International Diabetes Federation (IDF) MENA Region, in 2021, approximately 73 million people aged 20–79 were living with diabetes, a number expected to rise to 95 million by 2030. Additionally, 48 million individuals in the region had impaired glucose tolerance, increasing their risk of developing type 2 diabetes. Diabetes-related fatalities reached 796,000, and healthcare expenditures for diabetes stood at USD 33 billion in 2021. These alarming statistics are significantly driving the demand for diabetes care devices across the MEA region.

Technological innovation is also fueling market expansion. In May 2021, F. Hoffmann-La Roche Ltd partnered with Lilly to integrate Lilly's connected insulin pen into Roche's mySugr app across multiple countries. This initiative supports Roche’s Integrated Personalised Diabetes Management (iPDM) strategy and aims to simplify the daily decisions faced by insulin-dependent patients and their healthcare providers.

The introduction of advanced insulin delivery technologies is also accelerating market growth. For example, Medtronic plc launched InPen in November 2020, which works with real-time Guardian Connect CGM data to provide enhanced diabetes management. Ongoing innovation in insulin pens and continuous glucose monitors (CGMs) is expected to propel market growth further during the forecast period.

Rapid urbanization, rising obesity rates, sedentary lifestyles, and unhealthy habits such as smoking and alcohol consumption are contributing to a surge in diabetes cases. Moreover, the aging population is playing a critical role in expanding the diabetes patient pool. The World Health Organization (WHO) estimates that the global population aged 60 and above will increase from 1 billion in 2020 to nearly 2 billion by 2050, further boosting the demand for diabetes care devices.

Order a free sample PDF of the Middle East And Africa Diabetes Care Devices Market Intelligence Study, published by Grand View Research.

Country-Specific Insights:

- Iran: Projected to have 9.2 million diabetic individuals by 2030, the country faces rising diabetes-related mortality and high healthcare expenditures.

- Egypt: With 18.4% of adults affected b diabetes, Egypt’s aging population continues to drive demand for advanced diabetes management solutions.

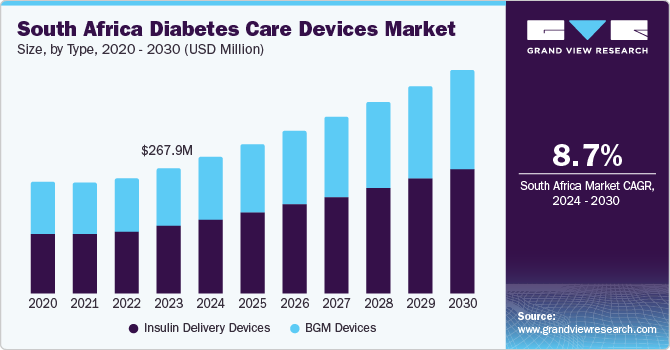

- Dominant Markets: South Africa, Saudi Arabia, UAE, Kuwait, Iran, and Oman are among the leading contributors to MEA market share.

Key Highlights:

- Market Size (2023): USD 1.03 billion

- Projected Market Size (2030): ~USD 1.78 billion (based on CAGR)

- CAGR (2024–2030): 8.20%

- IDF MENA 2021 Data:

- 73 million adults (20–79) affected

- Estimated increase to 95 million by 2030

- 796,000 diabetes-related deaths

- USD 33 billion in healthcare spending

- High Prevalence Countries: Iran, Egypt, South Africa, Saudi Arabia, UAE, Kuwait, Oman

- Notable Product Innovations: InPen (Medtronic), mySugr integration with Lilly insulin pen

- Leading Companies: Abbott, Dexcom, Roche, Medtronic, Novo Nordisk, among others

Key Companies Operating in the Market:

- Abbott

- Dexcom, Inc.

- Medtronic

- Hoffmann-La Roche Ltd

- Novo Nordisk A/S

- Ascensia Diabetes Care Holdings AG

- Bionime Corporation

- Agamatrix, Inc.

- Lifescan IP Holdings, LLC

- Insulet Corporation

- Lilly

- Sanofi

- Rossmax International Ltd.

These companies offer a range of devices, including blood glucose monitoring systems, CGMs, insulin pumps, testing strips, lancing devices, and integrated digital solutions aimed at simplifying diabetes management and improving patient outcomes.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion:

The MEA diabetes care devices market is witnessing robust growth, fueled by the region's escalating diabetes prevalence, aging population, and the rising demand for technologically advanced management tools. Strategic collaborations, product innovations, and increasing awareness are collectively shaping the future of diabetes care in the region.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness