-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

Africa Pharmaceutical Market Sees Growth in Herbal and Traditional Medicines

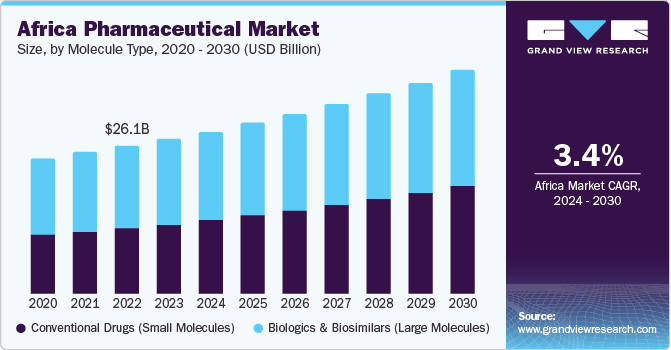

The Africa pharmaceutical market was valued at USD 26.85 billion in 2023 and is projected to advance at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030. Growth drivers include rising health‑consciousness, a climbing burden of chronic illnesses, and efforts to keep medicines affordable. The South African government, for example, anticipates higher pharmaceutical sales as infectious and lifestyle diseases such as obesity, hypertension, diabetes, and cancer remain widespread.

Steady improvements in Africa’s pharmaceutical infrastructure—supported by government initiatives aimed at safeguarding population health and modernizing healthcare services—are set to sustain momentum over the forecast period. National authorities now prioritize the safe, timely distribution of medicines, opening attractive opportunities for local manufacturers. The region’s pooled‑procurement initiatives further enhance the outlook for generic‑drug producers looking to establish plants, while South Africa’s organized cancer‑screening programs are expected to boost demand for oncological therapies.

Strong appetite for prescription generics, a maturing healthcare ecosystem, and the expansion of domestic manufacturing capacity underpin market growth. Local production has proved vital for supplying COVID‑19 therapeutics and other critical medicines. Added pressures from a growing elderly population, supportive regulatory policies, and a high prevalence of infectious diseases continue to lift pharmaceutical demand.

Molecule Type Insights

Based on molecule type, the market for conventional drugs (small molecules) dominated the market with a revenue share of 55.2 % in 2023. This growth can be attributed to a well-structured manufacturing facility, predictable pharmacokinetics, and oral bioavailability. Considering the emergence of cancer in the U.S., conventional drugs can be a good option for cancer treatment. In addition, proven significance, diverse applications, and patent expirations enable manufacturers to contribute to their widespread adoption. Moreover, these small molecules are preferred due to features such as the presence of good membrane penetration and better target delivery of drug.

The biologics& biosimilar segment is expected to witness growth with the fastest CAGR from 2024 to 2030. This is likely due to steady demand, its significance, and therapeutic advances of these molecules. Biologics & biosimilars can have a significant impact on immune interactions showcasing its importance in immune disorders.

Order a free sample PDF of the Africa Pharmaceutical Market Intelligence Study, published by Grand View Research.

Product Insights

Branded segment dominated the pharmaceutical market with a revenue share of 67.2% in 2023. The growth is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising demand for innovative therapies to treat various conditions. Key players perform acquisition and partnership to expand their product exposure and outcomes for patients. For instance, in September 2023, Novo Nordisk announced a partnership with Aspen Pharmacare to escalate insulin supplies in Africa.

The generic segment is expected to witness growth with the fastest CAGR from 2024 to 2030. The growth of this segment is likely due to outsourcing products at low cost, which in turn, increases the demand from the consumers. Moreover, high accessibility and affordability are likely to increase market growth. The implementation of a pooled procurement mechanism in Africa is expected to create a favorable environment for leading manufacturers of generics to build plants in the country.

Leading Companies in Africa

- Abbott Laboratories

- AbbVie

- Alfasigma

- Aspen

- Aurobindo Pharma

- AstraZeneca

- Bristol Myers Squibb

- BGM

- Cipla

- Sun Pharma

- Bayer

- Novartis

- Pfizer Laboratories

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

Africa’s pharmaceutical landscape is entering a pivotal growth phase. Continued investment in healthcare infrastructure, favorable regulatory support, and pooled‑procurement frameworks are positioning the continent as both a significant consumer and an emerging producer of medicines. While conventional small‑molecule drugs currently dominate, rapid uptake of biologics and biosimilars alongside accelerating generic production signal a diversified market ahead. Together, these trends—coupled with strategic collaborations among leading multinationals and regional players—suggest a resilient, steadily expanding pharmaceutical sector through 2030.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness