-

Feed de Notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

Europe Usage-Based Insurance Market Growth Drivers and Restraints | Industry Analysis 2025 - 2032

Executive Summary Europe Usage-Based Insurance Market :

Executive Summary Europe Usage-Based Insurance Market :

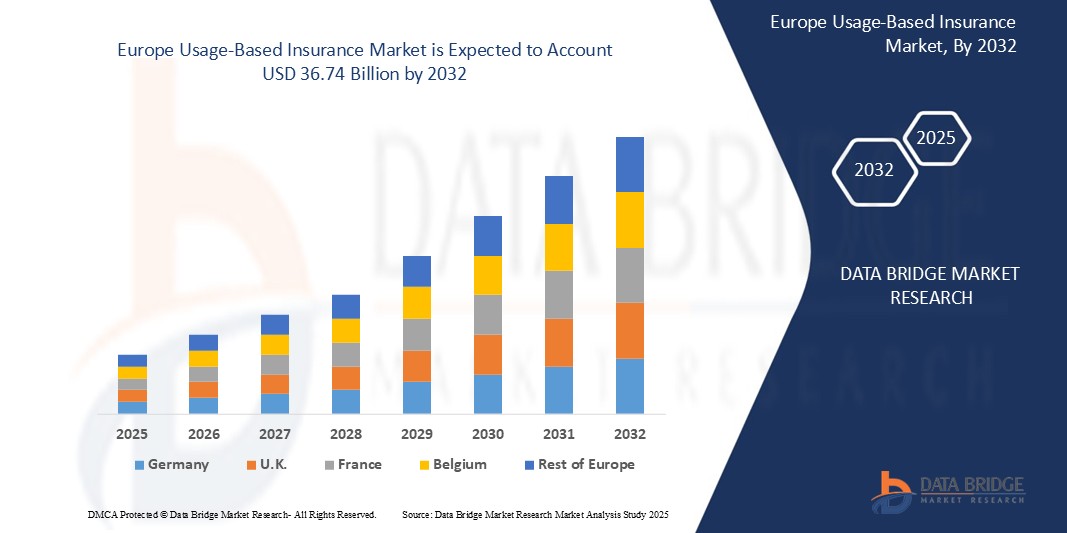

The Europe Usage-Based Insurance Market size was valued at USD 10.01 billion in 2024 and is expected to reach USD 36.74 billion by 2032, at a CAGR of 17.65% during the forecast period

The Europe Usage-Based Insurance Market research report delivers comprehensive analysis of the market structure along with forecast of the diverse segments and sub-segments of the market. The report considers an in depth description, competitive scenario, wide product portfolio of key vendors and business strategy adopted by competitors along with their SWOT analysis and porter's five force analysis. Europe Usage-Based Insurance Market report examines market by regions, especially North America, China, Europe, Southeast Asia, Japan, and India, focusing top manufacturers in global market, with respect to production, price, revenue, and market share for each manufacturer. The Europe Usage-Based Insurance Market report provides an in-depth overview of product specification, technology, product type and production analysis considering major factors such as revenue, cost, gross and gross margin.

The market transformations are highlighted in the Europe Usage-Based Insurance Market document which occurs because of the moves of key players and brands like developments, product launches, joint ventures, merges and accusations that in turn changes the view of the global face of industry. The market report evaluates CAGR value fluctuation during the forecast period. for the market. which will tell you how the Europe Usage-Based Insurance Market is going to perform in the forecast years by informing you what the market definition, classifications, applications, and engagements are. This Europe Usage-Based Insurance Market study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Europe Usage-Based Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market

Europe Usage-Based Insurance Market Overview

**Segments**

- **By Package Type:** The Europe usage-based insurance market can be segmented based on package type into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). PAYD policies calculate premiums based on the number of miles driven, PHYD policies assess driving behavior such as speed, acceleration, and braking, while MHYD policies consider driver habits and provide feedback for improvement.

- **By Vehicle Type:** Another key segmentation of the market is based on vehicle type, including passenger vehicles and commercial vehicles. Different insurance packages and pricing strategies can be tailored to meet the specific needs and usage patterns of these distinct vehicle types.

- **By Distribution Channel:** Distribution channels play a significant role in the adoption of usage-based insurance. The market can be segmented by distribution channel into direct sales and agency sales, each offering unique advantages and challenges in reaching and engaging with customers.

- **By End-User:** End-users of usage-based insurance in Europe can be segmented into individual drivers and fleet operators. The benefits and value propositions of usage-based insurance may vary based on whether the policyholder is an individual seeking personalized coverage or a fleet operator aiming to optimize their operations.

**Market Players**

- **Allianz Group:** One of the key players in the Europe usage-based insurance market, Allianz offers innovative telematics solutions and personalized insurance packages that cater to the evolving needs of customers seeking usage-based coverage.

- **Generali Group:** Generali Group is another prominent player driving the market with its focus on leveraging telematics technology to offer customized insurance products and services that promote safer driving habits and enhanced customer experiences.

- **Zurich Insurance Group:** Zurich Insurance Group is at the forefront of the usage-based insurance market, utilizing advanced data analytics and telematics solutions to develop dynamic pricing models and reward systems that incentivize policyholders for responsible driving behavior.

- **AXA Group:** AXA Group is a key market player that is actively shaping the landscape of usage-based insurance in Europe by introducing innovative offerings that combine telematics data with personalized risk assessments to deliver tailored coverage and value-added services.

- **Progressive Corporation:** Progressive Corporation stands out in the market with its pioneering Snapshot program, which uses telematics technology to track and analyze driving behavior, allowing customers to earn discounts based on their actual risk profiles and usage patterns.

- **State Farm Insurance Companies:** State Farm Insurance Companies have made significant strides in the Europe usage-based insurance market by deploying telematics devices and mobile apps that collect data on driver performance and facilitate personalized insurance solutions that align with individual needs and preferences.

The Europe Usage-Based Insurance Market is a dynamic and rapidly evolving landscape characterized by the emergence of innovative technologies, changing consumer preferences, and regulatory developments that shape the strategies and offerings of key market players. As the market continues to grow and mature, players across the insurance value chain are leveraging telematics solutions, data analytics, and customer-centric approaches to drive product innovation, enhance risk management practices, and deliver personalized experiences that cater to the diverse needs of individual drivers and fleet operators alike.

The Europe usage-based insurance market is witnessing a paradigm shift driven by technological advancements and changing consumer behaviors. This market evolution is prominently marked by the increasing adoption of telematics solutions and data analytics to offer personalized insurance packages and promote safer driving habits among policyholders. As consumers become more digital-savvy and demand tailored insurance solutions, market players are focusing on enhancing customer experiences through dynamic pricing models, reward systems, and feedback mechanisms based on driving behavior. This customer-centric approach is reshaping the traditional insurance landscape and fostering a more interactive and engaging relationship between insurers and policyholders.

Furthermore, the segmentation of the Europe usage-based insurance market based on package type, vehicle type, distribution channels, and end-users provides a comprehensive framework for understanding the diverse needs and preferences of different customer segments. By tailoring insurance packages to specific package types such as PAYD, PHYD, and MHYD, insurers can align their offerings with the varying driving habits and risk profiles of individual drivers and fleet operators. Moreover, the segmentation based on vehicle types enables insurers to develop customized pricing strategies and coverage options that cater to the unique requirements of passenger vehicles and commercial vehicles, thus maximizing market penetration and revenue potential.

In addition, the role of distribution channels in driving the adoption of usage-based insurance cannot be overstated. Direct sales and agency sales channels offer distinct advantages in reaching and engaging with customers, each requiring tailored marketing and sales strategies to effectively promote usage-based insurance products. By understanding the preferences and behaviors of end-users, insurers can optimize their distribution channels to ensure seamless customer acquisition and retention, thereby gaining a competitive edge in the dynamic marketplace.

Market players such as Allianz Group, Generali Group, Zurich Insurance Group, AXA Group, Progressive Corporation, and State Farm Insurance Companies are at the forefront of innovation in the Europe usage-based insurance market. These key players are leveraging telematics technology, data analytics, and personalized risk assessments to introduce novel offerings that drive product differentiation and enhance customer value propositions. As the market continues to evolve, collaboration among market players, regulators, and technology providers will be crucial in shaping the future trajectory of the usage-based insurance landscape in Europe.

In conclusion, the Europe usage-based insurance market presents vast opportunities for insurers to capitalize on the growing demand for personalized and data-driven insurance solutions. By embracing technological innovation, customer-centric approaches, and strategic collaborations, market players can navigate the evolving market dynamics, gain a competitive advantage, and deliver enhanced value to policyholders. The market's trajectory will be defined by its ability to adapt to changing consumer preferences, regulatory frameworks, and technological disruptions, laying the foundation for a more inclusive, efficient, and customer-focused insurance ecosystem in Europe.The Europe usage-based insurance market is poised for significant growth and transformation driven by a confluence of technological innovation, changing consumer behaviors, and regulatory frameworks. As insurers increasingly leverage telematics solutions and data analytics to offer personalized insurance packages tailored to individual driving habits and risk profiles, the market is witnessing a paradigm shift towards more customer-centric approaches that promote safer driving practices and enhance customer experiences. This shift is reshaping the traditional insurance landscape, fostering interactive relationships between insurers and policyholders, and driving product innovation to meet the evolving needs of the market.

Segmentation plays a crucial role in understanding the diverse needs and preferences of different customer segments within the Europe usage-based insurance market. By categorizing offerings based on package types such as PAYD, PHYD, and MHYD, insurers can align their products with varying driving behaviors and risk profiles, enhancing market penetration and revenue potential. Additionally, segmentation by vehicle types enables insurers to develop customized pricing strategies and coverage options tailored to the specific requirements of passenger vehicles and commercial vehicles, further optimizing market positioning and competitiveness.

The distribution channels also play a vital role in facilitating the adoption of usage-based insurance products. Direct sales and agency sales channels offer unique advantages in reaching and engaging with customers, necessitating tailored marketing and sales strategies to effectively promote usage-based insurance offerings. By understanding the preferences and behaviors of end-users, insurers can optimize their distribution channels to ensure seamless customer acquisition and retention, thereby gaining a competitive edge in the dynamic marketplace and driving market growth.

Key market players such as Allianz Group, Generali Group, Zurich Insurance Group, AXA Group, Progressive Corporation, and State Farm Insurance Companies are spearheading innovation in the Europe usage-based insurance market. These market leaders are leveraging advanced technologies, data analytics, and personalized risk assessments to introduce novel offerings that differentiate their products and enhance customer value propositions. Collaboration among market players, regulators, and technology providers will be essential in shaping the future trajectory of the usage-based insurance landscape, driving market evolution and ensuring sustainable growth in the European market.

In conclusion, the Europe usage-based insurance market presents a wealth of opportunities for insurers to meet the evolving demands of consumers for personalized, data-driven insurance solutions. By embracing innovation, customer-centric strategies, and strategic collaborations, market players can navigate the changing market dynamics, gain a competitive advantage, and deliver enhanced value to their policyholders. The market's future success will hinge on its ability to adapt to changing consumer preferences, regulatory requirements, and technological advancements, paving the way for a more efficient, inclusive, and customer-focused insurance ecosystem in Europe.

The Europe Usage-Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

- This study presents the analytical depiction of the global Europe Usage-Based Insurance Market Industry along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Europe Usage-Based Insurance Market

- The current market is quantitatively analyzed to highlight the Europe Usage-Based Insurance Market growth scenario.

- Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

- The report provides a detailed global Europe Usage-Based Insurance Market analysis based on competitive intensity and how the competition will take shape in coming years.

Browse More Reports:

Global Marine Fin Stabilizer Market

Global Biochips Market

Global Spirulina Powder Market

Global Potential Hydrogen (Ph) Adjusters Market

Global Automotive Telematics Market

Global Data Center Virtualization Market

North America Polylactic Acid (PLA) Market

Global Antisynthetase Syndrome Market

Global Capecitabine Market

North America Contrast Media Injectors Market

Global Traffic Jam Assist Systems Market

Global Human Rotavirus Vaccine Market

North America Reed Sensors Market

Global Personal Protective Gloves Market

Global Lurbinectedin Market

Global Gel Socks Market

Global Kaempferol Market

Europe Operating Room Equipment Supplies Market

Global Balsamic Vinegar Market

Global Mycoplasma Testing Market

Global Sanfilippo A Market

Nigeria Modified starch Market

Global Pectus Excavatum Treatment Market

Global Healthcare Nutrition Market

Middle East and Africa Pen Needles Market

Global Soybean Isolates Market

Global UX Service Market

North America Magnetic Resonance Imaging Devices Market

Global Methanol Market

Global Automotive Labels Market

Global Digital Vault Market

Global Cyclic Vomiting Syndrome Market

Europe Underactive Bladder Market

Europe Commercial Seaweed Market

Middle East and Africa Tank Insulation Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness