-

Noticias Feed

- EXPLORE

-

Páginas

-

Grupos

-

Eventos

-

Blogs

Middle East and Africa Usage Based Insurance Market Size and Growth | Comprehensive Industry Analysis 2025 - 2032

Executive Summary Middle East and Africa Usage Based Insurance Market :

Executive Summary Middle East and Africa Usage Based Insurance Market :

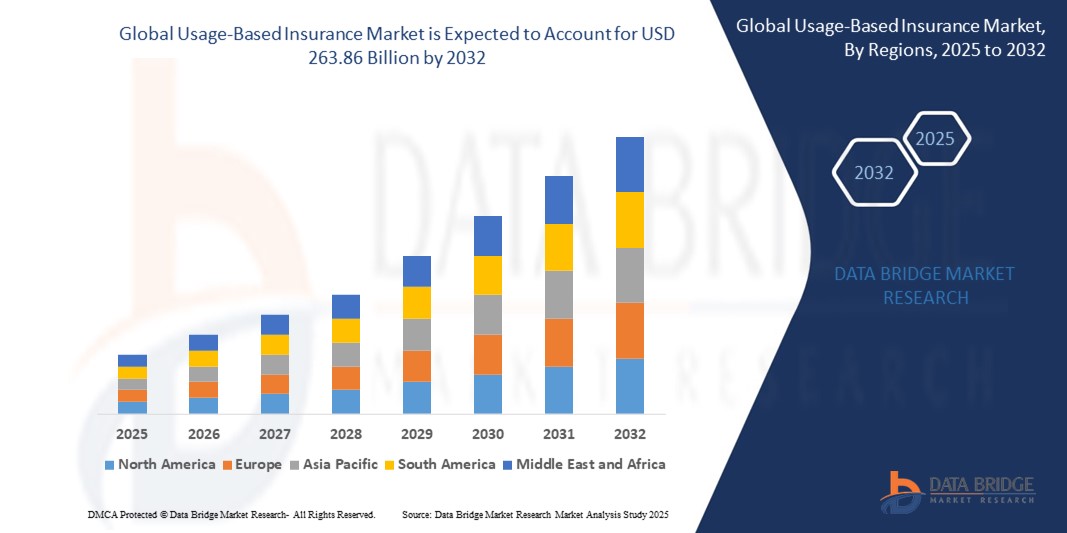

The Middle East and Africa Usage-Based Insurance Market size was valued at USD 2.12 billion in 2024 and is expected to reach USD 6.01 billion by 2032, at a CAGR of 13.90% during the forecast period

The Middle East and Africa Usage Based Insurance Market report is a synopsis about how is the market status right now and how will it be in the forecast years for industry. The report provides the facts of all the drivers and restraints which are derived through SWOT analysis. The report gives details about the top players and brands that are driving the market. It is a professional and detailed report that highlights primary and secondary drivers, market share, leading segments and geographical analysis. Also, Middle East and Africa Usage Based Insurance Market report gives an in-depth knowledge on what the recent developments, products launches are, while also keeping the track for recent acquisitions, mergers, joint ventures and competitive research in the global market industry.

All the numerical data included in the Middle East and Africa Usage Based Insurance Market business report is backed up by excellent tools such as SWOT analysis, Porter's Five Forces Analysis and others. This market report takes into consideration key market dynamics of sector. The current market scenario and future prospects of the sector have also been examined here. Further, it presents the company profile, product specifications, production value, contact information of manufacturer and market shares for company. The statistics are signified in graphical and tabular format for a clear understanding on facts and figures. The report also analyses the emerging trends along with major drivers, challenges and opportunities in the Middle East and Africa Usage Based Insurance Market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Middle East and Africa Usage Based Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-usage-based-insurance-market

Middle East and Africa Usage Based Insurance Market Overview

**Segments**

- By Package Type: Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive

- By Vehicle Type: Passenger Vehicle, Commercial Vehicles

- By Device Offering: Aftermarket, OBD-II, Smartphone, Embedded

- By Technology: OBD-II, Smartphone, Embedded

- By Vehicle Connectivity: 3G and 4G, 2G, 5G

Usage-based insurance (UBI) in the Middle East and Africa region is witnessing significant growth due to the increasing adoption of telematics technology and the rising demand for personalized insurance solutions. Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD) are the primary package types dominating the market. PAYD offers flexibility in premium payments based on actual driving behavior, while PHYD focuses on assessing risk based on driving habits, and MHYD provides feedback to drivers for improving their driving skills. Passenger vehicles and commercial vehicles are the two main segments in terms of vehicle type, with passenger vehicles holding a larger market share. Aftermarket, OBD-II, smartphone, and embedded devices are the key device offerings driving the UBI market, each catering to different consumer preferences and technological capabilities. OBD-II, smartphone, and embedded technologies are the major technologies utilized in UBI solutions, with each offering distinct advantages in terms of data collection and analysis. Furthermore, vehicle connectivity plays a crucial role in UBI, with 3G and 4G, 2G, and upcoming 5G networks enabling seamless communication between vehicles and insurance providers.

**Market Players**

- Intelligent Mechatronic Systems

- Cambridge Mobile Telematics

- AXA

- Allianz

- ASSICURAZIONI GENERALI S.P.A.

- Insure The Box Limited

- Mapfre

- Metromile

- Modus Group

- TomTom Telematics

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- Allstate Insurance Company

- State Farm Mutual Automobile Insurance Company

- Progressive Casualty Insurance Company

The Middle East and Africa Usage-Based Insurance Market is witnessing intense competition among key market players such as Intelligent Mechatronic Systems, Cambridge Mobile Telematics, AXA, Allianz, ASSICURAZIONI GENERALI S.P.A., and others. These companies are focusing on developing innovative telematics solutions, enhancing customer engagement, and expanding their product offerings to gain a competitive edge in the market. Partnerships, collaborations, and mergers and acquisitions are common strategies adopted by market players to strengthen their market position and extend their geographical presence. With the increasing demand for personalized insurance solutions and the growing adoption of telematics technology in the region, key market players are expected to invest significantly in research and development to introduce advanced UBI solutions tailored to the specific needs of consumers in the Middle East and Africa.

The Middle East and Africa region showcases immense potential for growth in the usage-based insurance (UBI) market, driven by the increasing integration of telematics technology and the escalating demand for customized insurance solutions. Market dynamics are shaped by various segments such as package type, vehicle type, device offering, technology, and vehicle connectivity, each playing a distinct role in defining the landscape of UBI in the region. As the market continues to evolve, it is essential for market players to understand the nuances of these segments and tailor their strategies accordingly to capitalize on emerging opportunities.

In terms of package types, the diversity offered by Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD) presents insurers with multiple avenues to cater to the varying needs of customers. While PAYD emphasizes flexibility in premium payments based on driving behavior, PHYD focuses on risk assessment through driving habits evaluation, and MHYD provides feedback for enhancing driving skills. Understanding the preferences of consumers within each package type can enable insurers to design more targeted and appealing UBI offerings.

Vehicle type segmentation between passenger vehicles and commercial vehicles plays a pivotal role in shaping the market landscape. With passenger vehicles holding a larger market share, insurers need to recognize the distinct requirements of both segments and tailor their UBI solutions to cater to the unique needs of each category. Commercial vehicles, with their specific usage patterns and operational requirements, present opportunities for insurers to develop specialized UBI offerings that align with the commercial sector's demands.

Device offering and technology segments, encompassing aftermarket, OBD-II, smartphone, and embedded devices, are crucial components driving UBI adoption and innovation. Each device type offers different functionalities and capabilities, influencing data collection, analysis, and overall user experience. Insurers need to stay abreast of technological advancements in OBD-II, smartphone, and embedded technologies to leverage the benefits they offer in enhancing the effectiveness of UBI programs and ensuring seamless integration with vehicle connectivity solutions.

Vehicle connectivity, facilitated by 3G and 4G, 2G, and upcoming 5G networks, plays a pivotal role in enabling real-time communication between vehicles and insurance providers. The evolution of connectivity technologies not only enhances data transmission efficiency but also opens up new possibilities for advanced UBI applications and services. Insurers must consider the implications of different connectivity options on UBI offerings and ensure compatibility with the evolving network infrastructure to provide reliable and value-added services to policyholders.

In conclusion, the Middle East and Africa Usage-Based Insurance Market present numerous growth opportunities for market players to capitalize on the evolving market trends and consumer preferences. By delving into the intricacies of each market segment and staying ahead of technological advancements, insurers can position themselves strategically to meet the dynamic demands of the UBI landscape in the region. Collaborations, innovation, and a customer-centric approach will be key differentiators for success in this competitive market, paving the way for sustainable growth and market leadership.The Middle East and Africa usage-based insurance (UBI) market is continuously evolving, driven by the increasing integration of telematics technology and the demand for personalized insurance solutions. The market is segmented based on various factors such as package type, vehicle type, device offering, technology, and vehicle connectivity. Understanding these segments is crucial for market players to tailor their strategies and offerings effectively in this competitive landscape. Package types like Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD) offer insurers diverse approaches to cater to different customer needs, allowing for flexibility in premium payments, risk assessment through driving habits, and feedback for driving skill improvement. Insurers need to analyze consumer preferences within each package type to design targeted and attractive UBI solutions.

The segmentation based on vehicle type, focusing on passenger vehicles and commercial vehicles, plays a significant role in shaping the market dynamics. Passenger vehicles currently hold a larger market share, necessitating insurers to develop tailored UBI solutions for both passenger and commercial vehicle segments. Commercial vehicles present specific usage patterns and operational requirements, offering insurers opportunities to create specialized offerings catering to the unique demands of the commercial sector. Understanding the distinct needs of these segments is vital for insurers to effectively penetrate the market and increase their competitiveness.

Device offerings and technology segments, including aftermarket, OBD-II, smartphone, and embedded devices, are key drivers influencing UBI adoption and innovation. Each device type comes with distinct functionalities and capabilities that impact data collection, analysis, and user experience. Insurers must stay abreast of technological advancements in OBD-II, smartphone, and embedded technologies to leverage their benefits and enhance the efficiency of UBI programs. By embracing these technologies effectively, insurers can ensure seamless integration with vehicle connectivity solutions, improving the overall user experience and the value proposition of their UBI offerings.

Vehicle connectivity, facilitated by different networks such as 3G and 4G, 2G, and upcoming 5G technologies, plays a crucial role in enabling real-time communication between vehicles and insurance providers. The advancement of connectivity technologies not only enhances data transmission efficiency but also opens up new avenues for advanced UBI applications and services. Insurers need to consider the implications of different connectivity options on their UBI offerings and ensure compatibility with evolving network infrastructure to deliver reliable and value-added services to policyholders. Overall, a deep understanding of these market segments and a proactive approach towards technological advancements will be essential for market players to thrive in the rapidly evolving Middle East and Africa UBI market.

The Middle East and Africa Usage Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-usage-based-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Core Objective of Middle East and Africa Usage Based Insurance Market:

Every firm in the Middle East and Africa Usage Based Insurance Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.Size of the Middle East and Africa Usage Based Insurance Market and growth rate factors.

- Important changes in the future Middle East and Africa Usage Based Insurance Market.

- Top worldwide competitors of the Middle East and Africa Usage Based Insurance Market.

- Scope and product outlook of Middle East and Africa Usage Based Insurance Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Middle East and Africa Usage Based Insurance Market.

Global Middle East and Africa Usage Based Insurance Market top manufacturers profile and sales statistics.

Browse More Reports:

Global Aerospace Insulation Coatings Market

Global Multicentric Reticulohistiocytosis Market

North America Food Pathogen Testing Market

Global Feed Acidifiers Market

Global Two-Hybrid Systems Market

Global Wood Heating Stoves Market

Global Direct Lateral Interbody Fusion (DLIF) and eXtreme Lateral Interbody Fusion (XLIF) Implants Market

Global PEGylated Protein Therapeutics Market

Europe Butyric Acid Market

Global Protective Clothing Market

Global Noodles Packaging Market

Global Webcams Market

Global Emulsifier for Bakery Products Market

Asia-Pacific Surgical Staplers Market

North America Urinalysis Market

Global 3D Projector Market

Global Polyol Sweeteners Market

Global Next Generation Display Market

Global Vendor Neutral Archive (VNA) Market

Europe Dental Radiology Equipment Market

Global Savory Ingredients Market

Global Electronically Scanned Array Market

Global Disposable Charcoal Activated Filter Face Masks Market

Asia-Pacific Orthopedic Braces and Supports Market

Global Potassium Sulfate Fertilizers Market

Canada Dunnage Packaging Market

Global Artificial Ventilation Market

Global Abdominal Adhesions Treatment Market

Global Welded Spiral Heat Exchangers Market

Global Endosulphane Market

Middle East and Africa Operating Room Equipment Supplies Market

Europe Semiconductor Manufacturing Equipment Market

North America Solid Phase Extraction Market

Global Food and Beverage Processing Equipment Market

Global Wireless Display Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness